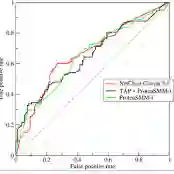

In credit scoring, machine learning models are known to outperform standard parametric models. As they condition access to credit, banking supervisors and internal model validation teams need to monitor their predictive performance and to identify the features with the highest impact on performance. To facilitate this, we introduce the XPER methodology to decompose a performance metric (e.g., AUC, $R^2$) into specific contributions associated with the various features of a classification or regression model. XPER is theoretically grounded on Shapley values and is both model-agnostic and performance metric-agnostic. Furthermore, it can be implemented either at the model level or at the individual level. Using a novel dataset of car loans, we decompose the AUC of a machine-learning model trained to forecast the default probability of loan applicants. We show that a small number of features can explain a surprisingly large part of the model performance. Furthermore, we find that the features that contribute the most to the predictive performance of the model may not be the ones that contribute the most to individual forecasts (SHAP). We also show how XPER can be used to deal with heterogeneity issues and significantly boost out-of-sample performance.

翻译:暂无翻译