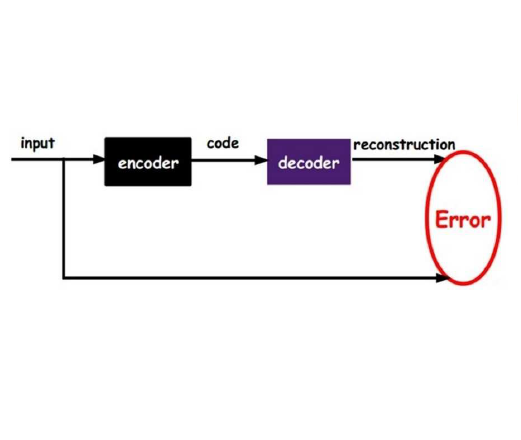

Financial simulators play an important role in enhancing forecasting accuracy, managing risks, and fostering strategic financial decision-making. Despite the development of financial market simulation methodologies, existing frameworks often struggle with adapting to specialized simulation context. We pinpoint the challenges as i) current financial datasets do not contain context labels; ii) current techniques are not designed to generate financial data with context as control, which demands greater precision compared to other modalities; iii) the inherent difficulties in generating context-aligned, high-fidelity data given the non-stationary, noisy nature of financial data. To address these challenges, our contributions are: i) we proposed the Contextual Market Dataset with market dynamics, stock ticker, and history state as context, leveraging a market dynamics modeling method that combines linear regression and Dynamic Time Warping clustering to extract market dynamics; ii) we present Market-GAN, a novel architecture incorporating a Generative Adversarial Networks (GAN) for the controllable generation with context, an autoencoder for learning low-dimension features, and supervisors for knowledge transfer; iii) we introduce a two-stage training scheme to ensure that Market-GAN captures the intrinsic market distribution with multiple objectives. In the pertaining stage, with the use of the autoencoder and supervisors, we prepare the generator with a better initialization for the adversarial training stage. We propose a set of holistic evaluation metrics that consider alignment, fidelity, data usability on downstream tasks, and market facts. We evaluate Market-GAN with the Dow Jones Industrial Average data from 2000 to 2023 and showcase superior performance in comparison to 4 state-of-the-art time-series generative models.

翻译:暂无翻译