【国际观察】澳洲央行行长:对官方代币持开放态度

本周三,澳大利亚央行行长Philip Lowe周三在2017年澳大利亚支付峰会(2017 Australian Payment Summit)上表示,澳大利亚可能批准一种名为“eAUD”的新形式电子支付方式。同时他还表态说,尽管他也承认未来电子支付将占据主流,但主角不会是比特币等加密货币,因为当前对于比特币的狂热迷恋更像是一种投机性的狂欢,而不是真的用作方便有效的电子支付方式。

至于eAUD,Lowe解释说这是一种电子钞票,或许会依托于分布式账本技术(DLT),这个想法迄今为止还没有正式成型,但央行对此持开放态度。

按照他的说法,发行机构可能以文档或者代币的形式发行“eAUD”电子货币,代币的话会存储在金融机构提供的电子钱包中,之后可以像实体钞票那样用来支付。

Lowe还解释道,原则上不会阻止私营部门发售eAUD代币,可以想见,银行甚至大型金融组织都有可能发行eAUD代币,但不太会以比特币等加密货币的形式,因为加密货币归根结底还是去中心化,背后并没有一个实体作支撑。

他说,从历史经验来看,私营部门的发售总是充斥着不稳定性,因此如果真的要发行一种能广泛使用的电子钞票,最好也是由央行来承担发行工作、金融机构承担分销工作,就像如今的实体钞票那样。

Lowe还指出,若在银行体系压力尚存的情况下贸然发行电子钞票,人们可能会寻求把商业银行里的存款都兑换成电子钞票,这可能给金融稳定造成冲击。有鉴于此,Lowe表示澳大利亚央行眼下还不打算发行电子钞票。

While the Reserve Bank of Australia (RBA) has accepted the future may be dominated by electronic methods of payment, it isn't convinced a physical banknote will no longer have a place, or that cryptocurrencies are the answer.

Speaking at the 2017 Australian Payment Summit in Sydney on Wednesday, RBA Governor Philip Lowe said although cryptocurrencies such as Bitcoin are becoming more prominent, they aren't commonly used for everyday payments and he does not see that changing any time soon.

"When thought of purely as a payment instrument, it seems more likely to be attractive to those who want to make transactions in the black or illegal economy, rather than everyday transactions," Lowe said.

"So the current fascination with these currencies feels more like a speculative mania than it has to do with their use as an efficient and convenient form of electronic payment."

According to Lowe, a new form of electronic payment method that could emerge would be in the form of electronic banknotes, or electronic cash -- an eAUD -- noting perhaps this could be through distributed ledger technology (DLT).

"The case for doing this has not yet been established, but we are open to the idea," he said.

Lowe explained the issuing authority could issue electronic currency in the form of files or tokens and the tokens could be stored in digital wallets that are provided by financial institutions. The tokens could then be used for payments in a similar way to how physical banknotes are used.

"In principle, there is nothing preventing tokenised eAUDs being issued by the private sector. It is conceivable, for example, that eAUD tokens could be issued by banks or even by large non-banks, although it is hard to see them being issued as cryptocurrency tokens under a Bitcoin-style protocol, with no central entity standing behind the liability," Lowe explained.

"The history of private issuance is one of periodic panic and instability ... if there were to be an electronic form of banknotes that was widely used by the community, it is probably better and more likely for it to be issued by the central bank."

According to Lowe, only 3.5 percent of "broad money" in Australia is in the form of physical currency, with the rest in the form of deposits.

"So the vast majority of what we know today as money is a liability of the private sector, and not the central bank, and is already electronic," he explained.

"If we were to issue electronic banknotes, it is possible that in times of banking system stress, people might seek to exchange their deposits in commercial banks for these banknotes, which are a claim on the central bank.

"This could have adverse implications for financial stability."

As a result, Lowe said the RBA has no immediate plans to issue an electronic form of Australian dollar banknotes.

Instead, Lowe feels it is likely the shift to electronic payments will occur largely through products offered by the banking system, given in Australia, unlike markets such as China and Kenya, the banking system has provided the infrastructure that has made the shift to electronic payments possible.

"At this stage, it seems likely that the banking system will continue to provide the infrastructure that Australians use to make electronic payments," he said. "This is particularly so given the substantial investment made by Australia's financial institutions in the NPP."

The New Payments Platform (NPP), expected to go live in February, will see Australians transfer funds in near real-time between bank accounts using an email address or phone number, rather than the traditional BSB or account number process, regardless of the financial institutions involved.

"An electronic form of banknotes could coexist with the electronic payment systems operated by the banks, although the case for this new form of money is not yet established," Lowe said.

"If an electronic form of Australian dollar banknotes was to become a commonly used payment method, it would probably best be issued by the RBA and distributed by financial institutions, just as physical banknotes are today."

On Tuesday, the United States Securities and Exchange Commission (SEC) Chairman Jay Clayton warned people conducting initial coin offerings (ICOs) that they could fall foul of US security laws.

An ICO is a form of internet-based crowdfunding that can be a source of capital where, in return for investor cash, the organisation making the offer provides virtual coins or tokens, with the recorded transaction stored on a blockchain. The structure of the ICO determines whether security laws in various jurisdictions apply.

Clayton's comments followed the SEC ordering California-based Munchee Inc to halt its ICO, after the SEC found its conduct constituted unregistered securities offers and sales.

The company was selling digital tokens to investors to raise $15 million for its blockchain-based iPhone app food review service.

"We will continue to scrutinise the market vigilantly for improper offerings that seek to sell securities to the general public without the required registration or exemption," Stephanie Avakian, co-director of the SEC's Enforcement Division, said in a statement.

"In deciding not to impose a penalty, the commission recognised that the company stopped the ICO quickly, immediately returned the proceeds before issuing tokens, and cooperated with the investigation."

The SEC's new Cyber Unit, which requested Muchee halt its ICO, is focused on misconduct involving DLTs and ICO; the spread of false information through electronic and social media; brokerage account takeovers; hacking to obtain nonpublic information; and threats to trading platforms.

The unit earlier this month filed charges alleging ICO fraud after PlexCorps raised up to $15 million from thousands of investors since August by falsely promising a 13-fold profit in less than a month.

译者:火币区块链应用研究院

原文来源: ZDNet

行业时事

浙江备案提速明年3月整改完毕 摩根史坦利推出智能投顾平台Access Investing

“现金贷”新规落地 委内瑞拉宣布将设立数字货币"Petro"

案例分析

监管动态

深度观察

活动&荐书

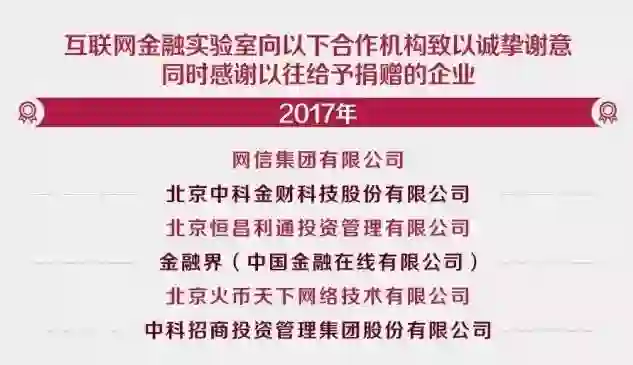

清华大学五道口金融学院互联网实验室成立于2012年4月,是中国第一家专注于互联网金融领域研究的科研机构。

专业研究 | 商业模式 • 政策研究 • 行业分析

内容平台 | 未央网 • "互联网金融"微信公众号iefinance

创业教育 | 清华大学中国创业者训练营 • 全球创业领袖项目(报名中!点击查看详情)

网站:未央网 http://www.weiyangx.com

免责声明:转载内容仅供读者参考。如您认为本公众号的内容对您的知识产权造成了侵权,请立即告知,我们将在第一时间核实并处理。

WeMedia(自媒体联盟)成员,其联盟关注人群超千万