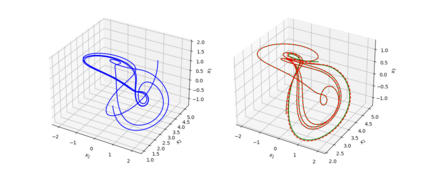

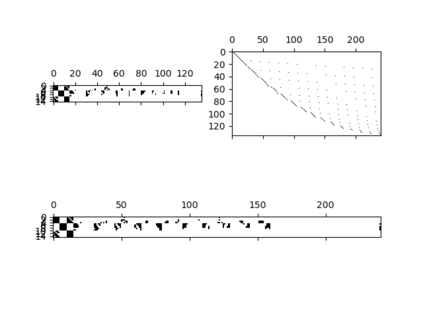

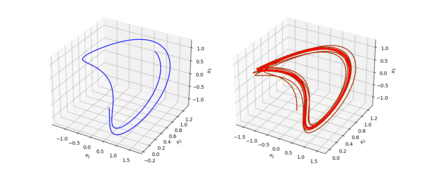

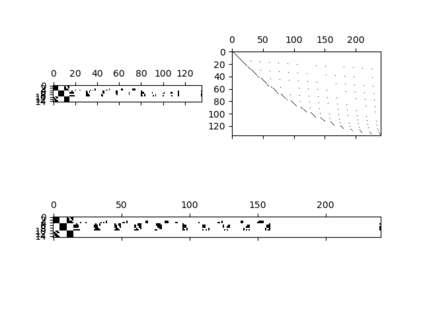

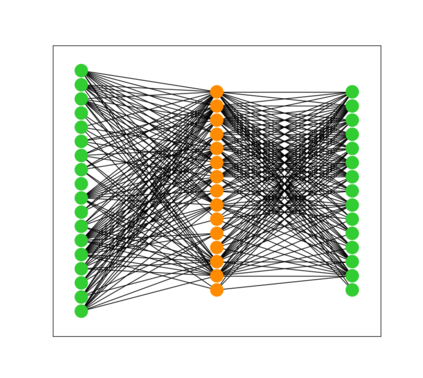

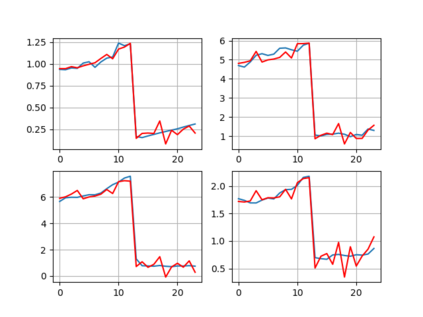

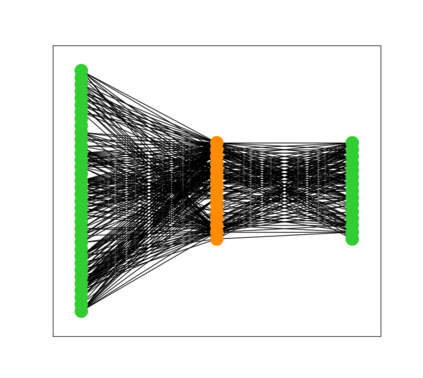

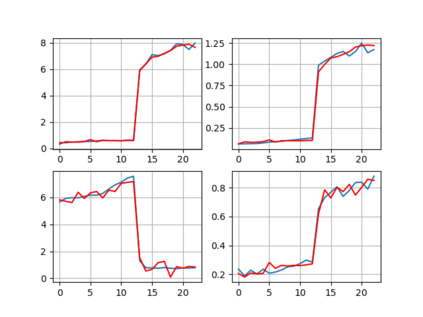

In this document, we present key findings in structured matrix approximation theory, with applications to the regressive representation of dynamic financial processes. Initially, we explore a comprehensive approach involving generic nonlinear time delay embedding for time series data extracted from a financial or economic system under examination. Subsequently, we employ sparse least-squares and structured matrix approximation methods to discern approximate representations of the output coupling matrices. These representations play a pivotal role in establishing the regressive models corresponding to the recursive structures inherent in a given financial system. The document further introduces prototypical algorithms that leverage the aforementioned techniques. These algorithms are demonstrated through applications in approximate identification and predictive simulation of dynamic financial and economic processes, encompassing scenarios that may or may not exhibit chaotic behavior.

翻译:暂无翻译