In the recent Basel Accords, the Expected Shortfall (ES) replaces the Value-at-Risk (VaR) as the standard risk measure for market risk in the banking sector, making it the most important risk measure in financial regulation. One of the most challenging tasks in risk modeling practice is to backtest ES forecasts provided by financial institutions. To design a model-free backtesting procedure for ES, we make use of the recently developed techniques of e-values and e-processes. Model-free e-statistics are introduced to formulate e-processes for risk measure forecasts, and unique forms of model-free e-statistics for VaR and ES are characterized using recent results on identification functions. For a given model-free e-statistic, optimal ways of constructing the e-processes are studied. The proposed method can be naturally applied to many other risk measures and statistical quantities. We conduct extensive simulation studies and data analysis to illustrate the advantages of the model-free backtesting method, and compare it with the ones in the literature.

翻译:暂无翻译

相关内容

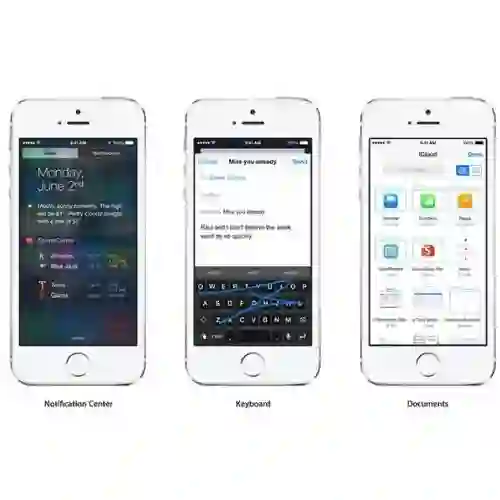

- Today (iOS and OS X): widgets for the Today view of Notification Center

- Share (iOS and OS X): post content to web services or share content with others

- Actions (iOS and OS X): app extensions to view or manipulate inside another app

- Photo Editing (iOS): edit a photo or video in Apple's Photos app with extensions from a third-party apps

- Finder Sync (OS X): remote file storage in the Finder with support for Finder content annotation

- Storage Provider (iOS): an interface between files inside an app and other apps on a user's device

- Custom Keyboard (iOS): system-wide alternative keyboards

Source: iOS 8 Extensions: Apple’s Plan for a Powerful App Ecosystem